Suriname – What employers should know about the pension scheme of the Algemeen Pensioenfonds (APF)

Written by Joan Rampersad

Posted on 26 Jul 2023 - 2 minutes read

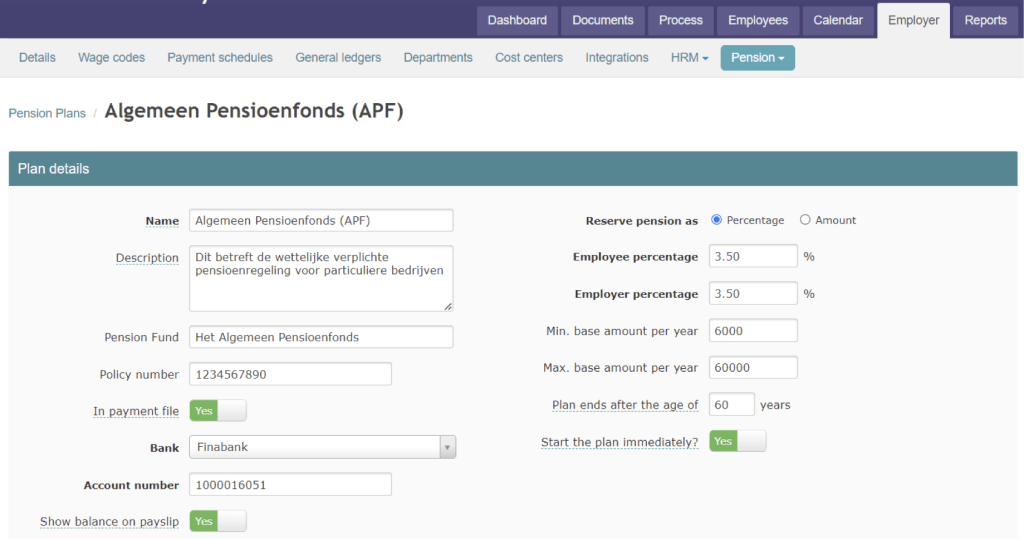

The General Pension Act 2014 was launched in Suriname on December 9, 2014. The implementing organization is the Algemeen Pensioenfonds (APF).

It is a legal obligation for private companies to provide their employees with a pension plan with APF. Employers must process the pension premium in the payroll administration and pay the total pension premium to the APF.

This scheme applies to employees aged from 18 to 60 years. The employer and the employee both pay 50% of the total pension premium. For the employee, 50% of the total pension contribution is deducted from the gross / taxable salary. The employer will have to pay the remaining 50% of the pension premium. The amount of the pension contribution is determined based on the employee’s gross salary.

At the start of this Pension plan in January 2015, the total premium amounted to 3.0% and from 2016 the total premium has increased by 0.5% each year. As a result, the total premium is currently (in 2023) 7.0%. In 2023, both employer and employee will therefore each pay a premium of 3.5%.

The law also stipulates that the total premium will increase annually by 0.5% until a total premium of 28% has been reached. This 28% will therefore only be reached in 42 years (in 2065).

It is also important to know that a minimum and maximum premium and base salary applies. For example, the pension premium must be calculated annually at a minimum of SRD 6,000 wages per employee. On a monthly basis, this concerns a minimum basis of SRD 500 per month. So even if an employee earns less than SRD 500 in a month, the pension premium will have to be calculated based on SRD 500 per month.

The maximum pension base is SRD 60,000 per year. So, for employees that earn SRD 5,000 (or more) per month, the pension premium will have to be calculated monthly on a maximum of SRD 5,000. In 2023, this amounts to a maximum premium of SRD 700 per month, divided 50/50 or SRD 350 per month for both employer and employee.

This APF Pension plan can be created in Celery under Employer/Pension Plans and linked to all employees with at the touch of one button.

And on January 1st of each year, in this Pension Plan you increase the premium for both employer and employee by 0.25% (total of 0.5% increase) and as soon as you save that change, also the pension premium is adjusted at the touch of one button for all linked employees.

In this way, Celery makes it very easy for you!

Thousands of companies use Celery. Are you switching too?

Pricing for Celery starts at $20 per month.