Taxes and premiums 2025

Written by Sue van Elteren

Posted on 3 Jan 2025 - 2 minutes read

For almost all 7 countries in Celery, the official wage tax tables and social premiums for 2025 are known. Below we provide some notable changes.

Aruba

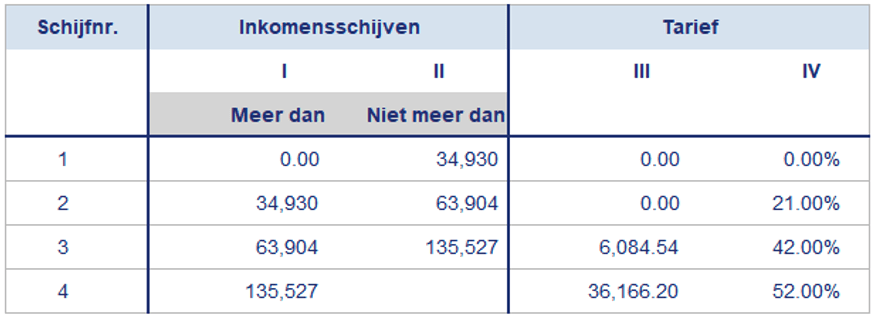

In 2025, the Tax-free amount and the Wage tax brackets have remained the same as in 2024. However, In 2025, the rate of the first bracket has been adjusted from 10% to 0%, see the table below.

The social premiums have remained unchanged in 2025.

Caribbean Netherlands

The tax-free amount has increased by USD 949 from USD 20,424 to USD 21,373 per year. In terms of wage tax, a new rate of 35.4% has been introduced in 2025 in addition to the existing rate of 30.4%. This higher rate applies to taxable income above USD 51,250 per year. So only the additional taxable salary above USD 4,270.83 per month is subject to the aforementioned 35.4% Wage Tax. The ZV/OV/Cessantia Premium has increased by 0.8% in 2025 from 0.2% to 1.0%. The Health Insurance Premium, on the other hand, has decreased by 2.4% from 11.7% to 9.3%.

Suriname

For the time being, no changes are known for 2025 compared to 2024.

British Virgin Islands

The maximum SSB insurable earning has been increased from USD 49,000 to USD 51,000 in 2025. The maximum NHI insurable earning has been increased from USD 98,000 to USD 102,000 in 2025.

Guyana

There are no changes in 2025 compared to 2024. Perhaps later after the annual budget presentation that we expect in January 2025.

Curaçao

The Income tax rates have remained the same as in 2024, but the tax brackets have become somewhat wider in 2025. As a result, employees will pay less wage tax per month in 2025 on the same salary as in 2024. In addition, all fiscal allowances have increased by a few guilders per year. The SVB wage limit has increased from ANG 81,229.20 to ANG 83,850.00 per year. This amounts to an SVB wage limit of ANG 6,987.50 per month. The other social premiums remain unchanged.

Sint Maarten

The maximum SZV wage limit of the AOV/AWW premium has increased from ANG 117,019.61 to ANG 131,966.57 per year in 2025. Regarding the Wage Tax and fiscal allowances, the 2023 tables and allowances have recently been published. These 2023 rates will be applied in Celery in 2024 and 2025. In the meantime, we are awaiting the 2024 and 2025 tax tables and fiscal allowances.

Thousands of companies use Celery. Are you switching too?

Pricing for Celery starts at $20 per month.